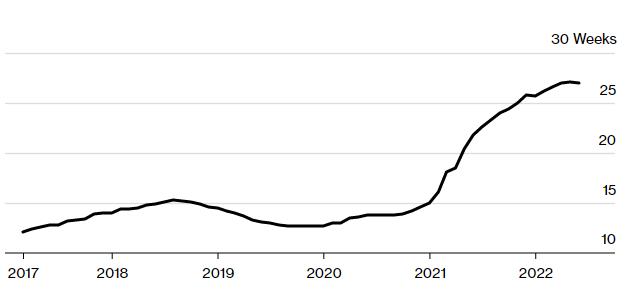

Lead times, a key metric closely watched between semiconductor ordering and delivery, averaged 27 weeks in June, compared with 27.1 weeks in May, according to research by market analysts at Haina International. These are signs of slowing supply chain inflation, slowing price increases and possibly ‘peak delivery times’.

Based on key data or forecast data, Haina International found that chip delivery times for some large companies fell for the second month in a row, with some companies seeing chip delivery times falling by as much as 45%. The chip types with the greatest reduction in lead time are microcontroller components, power management chips, and memory chips.

Lead times for field programmable gate arrays (FPGAs) remain the longest of the 52-cycle lead time cap, and may be the most constrained segment of the entire ecosystem, the study said. Heiner International added that the FPGA shortage will affect networking, optical and telecom equipment.

The bottleneck caused by the supply of chips has negatively affected companies in various industries such as Toyota Motor and Apple. The companies even lost billions of dollars in revenue because they couldn’t get enough chips to meet product demand.

According to Gartner’s forecast, semiconductor sales will grow by 13% in 2022, but the downturn in PCs and smartphones and the expectation of a recession, the semiconductor market is at risk of uncertainty.